2011年7月7日 星期四

波動率變化

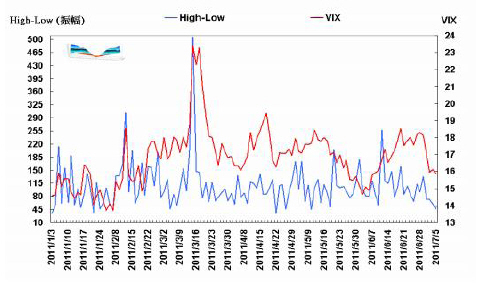

近月台指期振幅從90點縮小至47點,VIX指數由於近七天已重跌19.40%,今天不斷有伺機反彈的企圖,但股市空頭力道仍不足,期貨指數最後收在平盤,VIX指數只好再續跌 1.38%至15.09,不過跌幅已比前兩日縮小。 而另一方面,歷史波動率也是續跌1.13%至16.36,近五天以來歷史波動率共跌9.87%。連續六日IV低於HV,IV-HV則從-1.25擴大至-1.27。

選擇權風險分析

更由於目前隱含波動率皆略低於歷史波動率與長期平均波動率,顯示目前市場交易出來的波動率已迴歸至均值以下,對於賣Vega(Delta-gamma中立)者的潛在利潤已大幅減少,而因為近月份契約離到期日只剩9天,已經進入了時間價值流失加速期,對於賣Gamma(Delta-vega中立)者較為有利,預估明天七月份的每口ATM Gamma (1%大盤變動率)在330元、ATM Vega (1% IV變動率)在330元、ATM Call Theta會流失269元、ATM Put Theta會流失236元。依照上述的情況,可採取Long Vega-Short Gamma賺取價差。或可買期貨,並在選擇權組合中以買 Put的Vega加上賣Call的Gamma為主。

大盤(台指期貨)走勢機率

依目前的GARCH模型來看,歷史波動率連續第二天在長期平均波動率之下,依照以往統計,盤勢持續走堅機率高達六成。 以目前的VIX作台指期的下一個標準差作落點分析,未來9個交易日內,約有80%的機率會在8485~8895之間結算。 以Delta與Gamma對於波動率的敏感度來研判,預計七月份賣權與買權的最大OI序列會分別移動到8400與9000附近,而八月份賣權與買權的最大OI序列會分別移動到8200與9000附近。

2010年3月20日 星期六

Volatility on the brink of rebound

Dispersion analysis and update on the US implied correlation

TAIEX 10-day skewness had touched positive zone for the first time since February 4th and 10-day kurtosis remains negative since last Tuesday as TAIEX jumped 4.74% in 10 trading days and market volatility grounded. In the past 3 days, the US implied correlation index sees 2.15% rebound, which means that more volatile move is expected to happen.

Investor sentiment

Taiwan investor sentiment is quite neutral according to turnover to market cap ratio, which has hovered around 0.50 since February. Although short sell has increased substantially since February 6th, it’s still lower than the 7-month average at 0.80 million shares. Additionally, OI Put/Call ratio has exceeded 1.00 recently but Call/ Put IV ratio still unable to break 0.85 as TAIEX faces strong resistance at 7800 sjnce March.

Volatility analysis and forecast

10D realized volatility and implied volatility had dropped 61% and 34%, respectively, since the breakout of Greek debt event. After these days of quiet market, GARCH forecasting curve has inverted from negative to positive slope. Meanwhile, IV/HV ratio is already on the rise on the 3rd day but still below the 8-month average at 1.49. The US VIX index also rebounded a little in the past 3 days. To conclude, TAIEX OTM put is potentially underpriced and it’s about the time to take profit from vega short and theta long position of March contract.

TAIEX 10-day skewness had touched positive zone for the first time since February 4th and 10-day kurtosis remains negative since last Tuesday as TAIEX jumped 4.74% in 10 trading days and market volatility grounded. In the past 3 days, the US implied correlation index sees 2.15% rebound, which means that more volatile move is expected to happen.

Investor sentiment

Taiwan investor sentiment is quite neutral according to turnover to market cap ratio, which has hovered around 0.50 since February. Although short sell has increased substantially since February 6th, it’s still lower than the 7-month average at 0.80 million shares. Additionally, OI Put/Call ratio has exceeded 1.00 recently but Call/ Put IV ratio still unable to break 0.85 as TAIEX faces strong resistance at 7800 sjnce March.

Volatility analysis and forecast

10D realized volatility and implied volatility had dropped 61% and 34%, respectively, since the breakout of Greek debt event. After these days of quiet market, GARCH forecasting curve has inverted from negative to positive slope. Meanwhile, IV/HV ratio is already on the rise on the 3rd day but still below the 8-month average at 1.49. The US VIX index also rebounded a little in the past 3 days. To conclude, TAIEX OTM put is potentially underpriced and it’s about the time to take profit from vega short and theta long position of March contract.

訂閱:

文章 (Atom)